Bank Reconciliation

For each General Ledger Account used in the system, there is a corresponding Bank Account, as established in the Maintain Bank Master routine. Therefore, transactions affecting General Ledger Accounts are reflections of transactions affecting the actual Bank Account. For example, when the user posts a transaction in eQuinox that debits a specified GL Account, the corresponding Bank Account will also be debited when the transaction is processed. The Bank Reconciliation routine allows the user to compare Bank Statements to the Firm's eQuinox Account Statements and ensure that the transactions and balances of the GL Accounts and the Bank Accounts are in sync.

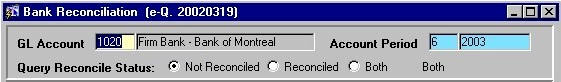

When the Bank Reconciliation routine is accessed from the eQuinox main menu, the screen shown below will be displayed.

Field Definition

Entering Query Criteria

The first section of this form allows the user to enter query criteria. The user can execute a query based solely on the GL Account and the Accounting Period, or they may also select whether or not Reconciled Records are to be included in the query results as well.

GL Account - The GL Account for which the user wishes to view transaction details. A selection may be made from the List of Values provided.

Query Reconcile Status - These three options allow the user to choose the types of records they want returned in the query results. To show only those records that are not yet reconciled, the user must select the Not Reconciled option; to show only those records that have been reconciled, the user must select the Reconciled option; to show all records, regardless of reconcile status, the user must select the Both option.

Account Period - This field defaults to the current accounting period. The user may enter a different period if they wish to execute a query based on a previous accounting period.

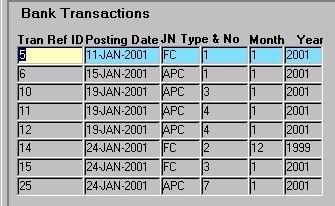

Bank Transactions

The following section of the form displays the query results. Details for each transaction for the specified GL Account (i.e. the GL Account that the query was based on) are displayed. Note: This section offers the user two options for reconciling records; they can either user the Recon field to select records for reconciliation, or they can use the Reconcile Mode, Using, #/ID, and Amount fields to manually enter the information for the records they wish to reconcile.

Tran Ref ID - The Transaction Reference ID, as was assigned to this transaction when it was first entered into the system.

Posting Date - The date on which the current transaction took place.

JN Type & No - The Journal Type and the Journal Number through which the current transaction was posted to the General Ledger.

Month, Year - The accounting month and year during which the current Journal was posted to the General Ledger.

Chq/Rcpt No - This field displays either the Cheque number or the Receipt number, depending on the type of transaction. For example, if the current record is a Credit record (i.e. a Trust Receipt), this field will display the Trust Receipt number. If the current record is a Debit record (i.e. a Trust Cheque), this field will display the Trust Cheque number.

Description - A description of the Batch (i.e. group of records) in which the current transaction was entered and posted to the General Ledger.

Cheques - If the current record is a Cheque (a Debit record), this field will display the amount of the Cheque (the amount Debited from the account when the transaction was processed).

Deposits - If the current record is a Deposit (a Credit record), this field will display the amount of the Receipt (the amount Credited to the account when the transaction was processed).

Rev - Indicates whether or not the current Cheque or Receipt has been reversed. If the record has been reversed, this field will automatically be 'checked', and cannot be changed by the user.

Recn'D (Option #1) - To select a record for reconciliation, the user must 'check' this field. Once all desired records have been selected, the user must click the Save button or press F10 to complete the reconciliation process. If the user has included reconciled records in their query, records that have been previously reconciled will be displayed, with this field 'checked'. Note: This is only the first of two options for reconciling records; the second option is explained below).

The section seen below represents Option #2 for reconciling records. Rather than just selecting records for reconciliation, the use must enter the appropriate reconciliation details and then click the Save button or press F10 to complete the process.

![]()

Cheque/Deposit - The user must select a reconciliation mode from the drop down list provided. For example, if the user wants to reconcile a Cheque (Debit record), they must select the "Cheques" option; if the user wants to reconcile a Receipt (Credit record), they must select the "Receipt" option.

Using - The user must select from the drop down list the type of record identification that will be used in the reconciliation. For example, to use the Transaction Reference ID as a means of identification for the record being reconciled, the user must select the "ID - Tran Ref ID" option; to use the Journal Number as a means of identification for the record being reconciled, the user must select the "Number - Journal Number" option.

Tran Ref Id/Chq Rcpt No - Depending on the selection made in the previous field, the user must enter either the Cheque or Receipt Number or the Transaction Reference ID of the record that is being reconciled. For example, if the user selected the "Tran Ref ID" option in the previous field, they must enter the actual Transaction Reference ID in this field.

Amount - The user must enter the transaction amount, as appears on the actual Bank Account Statement. If this amount differs from the system statement amount, the two accounts are not in sync, and their balances will likely be different.

The section of the form seen below displays general information about the query results as a whole.

Cheques Reconciled, Deposits Reconciled - The Count field displays the total number of Reconciled Debit records (Cheques) and the total number of Reconciled Credit records (Receipts) that were returned in the query results; the Total Amount fields display the total dollar amount of the Reconciled Debit records (Cheques) and the total dollar amount of the Reconciled Credit records (Receipts) that were returned in the query results.

Cheques Unreconciled, Deposits Unreconciled - The Count field displays the total number of Unreconciled Debit records (Cheques) and the total number of Unreconciled Credit records (Receipts) that were returned in the query results; the Total Amount fields display the total dollar amount of the Unreconciled Debit records (Cheques) and the total dollar amount of the Unreconciled Credit records (Receipts) that were returned in the query results.

Once the user has finished entering or updating information, they must click the Save button or press F10 to commit the changes to the database.